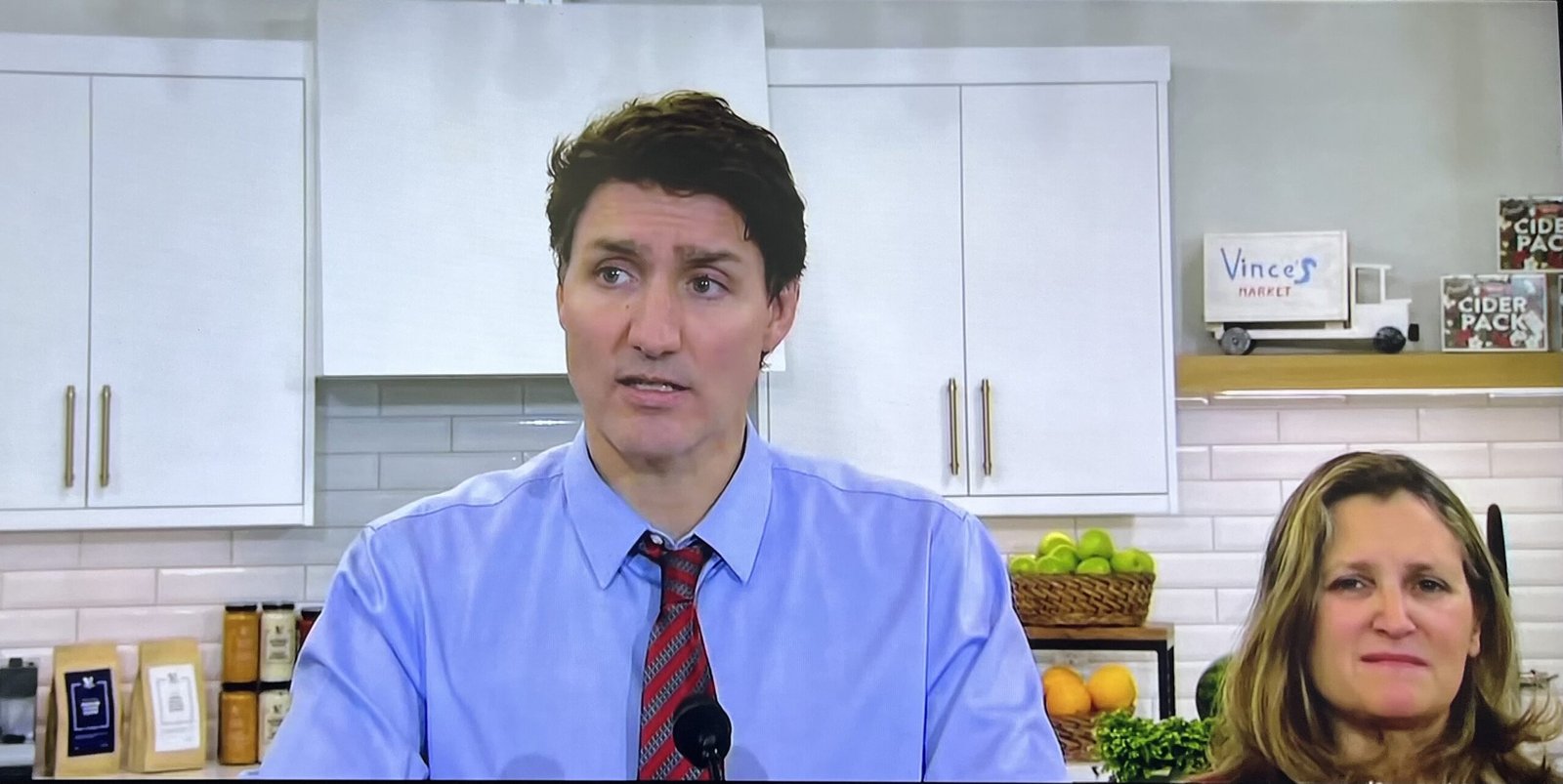

Ottawa – In an effort to ease affordability challenges for Canadians, Prime Minister Justin Trudeau unveiled a series of measures on Thursday, including a two-month GST holiday and a direct rebate for millions of workers.

From December 14, 2024, to February 15, 2025, Canadians can enjoy tax-free purchases on a range of essential goods and services, including:

– Prepared Foods: Vegetable trays, pre-made meals, salads, sandwiches, and snacks like chips and candy.

– Restaurant Meals: Dine-in, takeout, and delivery options.

– Children’s Essentials: Clothing, footwear, car seats, and diapers.

– Recreational Goods: Toys, board games, video game consoles, books, puzzles, and print newspapers.

– Seasonal Items:Christmas trees.

– Beverages: Beer, wine, cider, and low-alcohol drinks (under 7% ABV).

These exemptions mean most food items in Canada will effectively be tax-free during this period. According to government estimates, a family spending $2,000 on these goods could save approximately $100.

To further support affordability, the government will issue a $250 rebate—dubbed the “Working Canadians Rebate”—to the 18.7 million Canadians who earned $150,000 or less in 2023. Payments are set to arrive in early spring 2025.

On Wednesday, NDP Leader Jagmeet Singh expressed support for the GST holiday, signaling broad political backing for the measure. “These steps provide some relief for Canadians struggling with the rising cost of living,” Singh said.

The measures aim to provide short-term relief amid ongoing affordability challenges in the post-COVID economy, particularly for families and low- to middle-income earners.